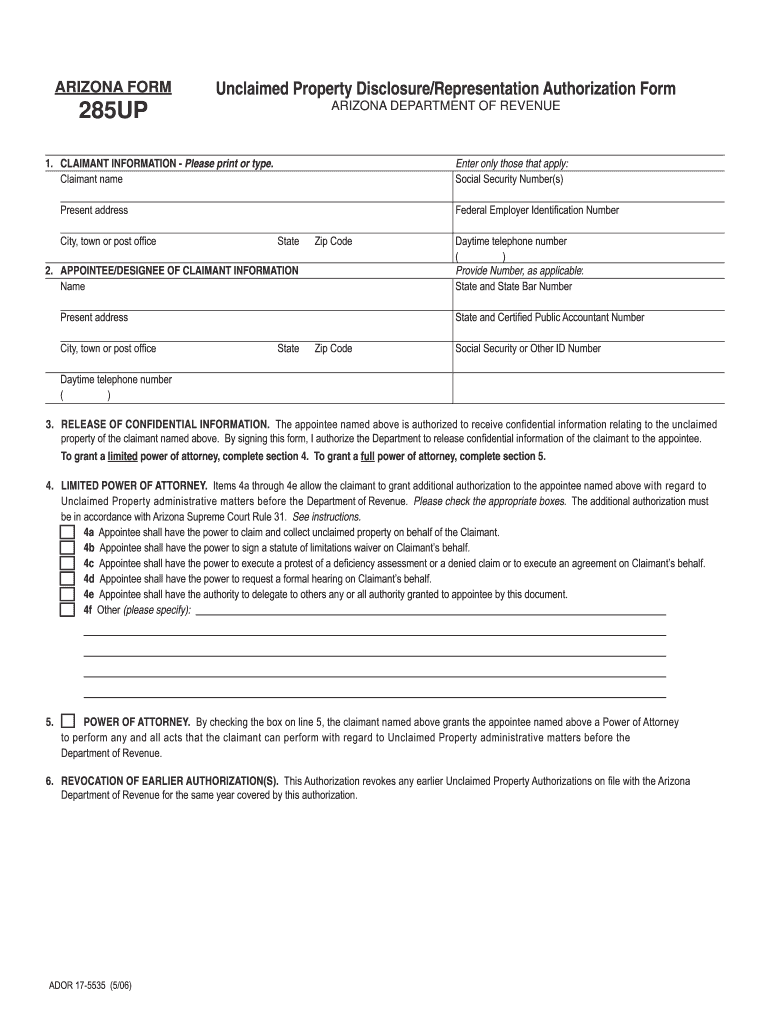

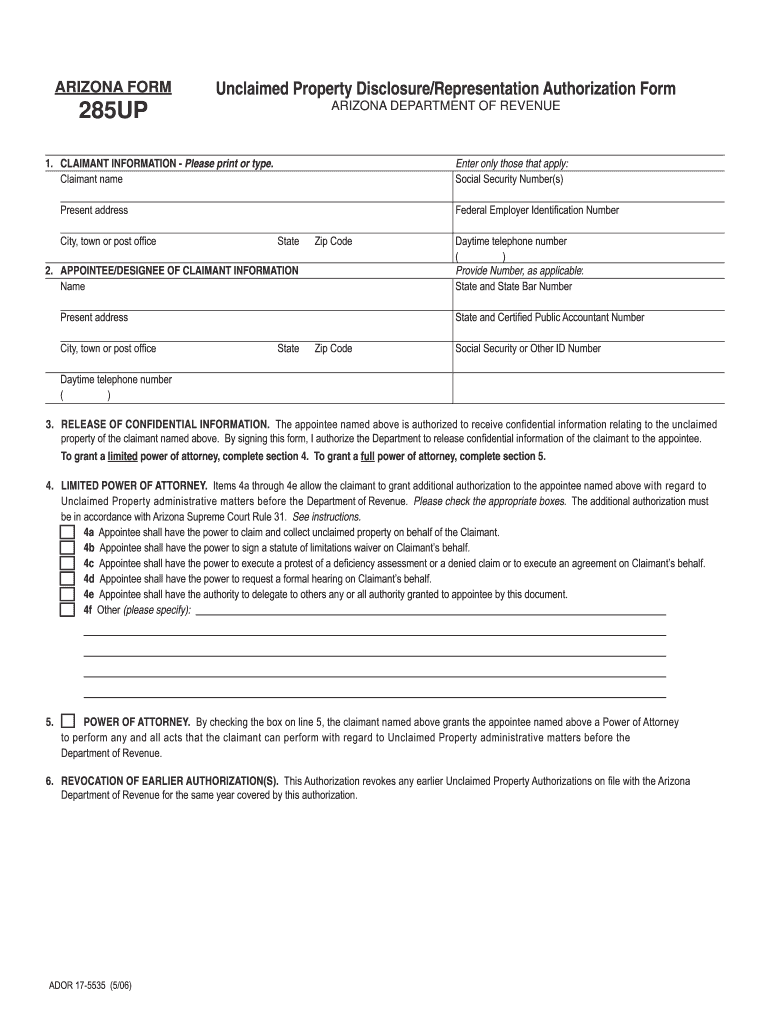

AZ 285UP 2006-2024 free printable template

Get, Create, Make and Sign

Editing arizona form 285up online

How to fill out arizona form 285up

How to fill out Arizona form 285up:

Who needs Arizona form 285up:

Video instructions and help with filling out and completing arizona form 285up

Instructions and Help about az property disclosure authorization form

The Arizona Department of Revenue presents an overview of form 285 the general disclosure of representation authorization form 285 is used to authorize the department to release confidential information to the taxpayers appointee the department may have to disclose confidential information to fully discuss tax issues with or respond to tax questions by the appointee a taxpayer may also use the form 285 to grant additional powers to the appointee up to and including a power of attorney any of the following may file a form 285 an individual or individuals that file a joint return a sole proprietorship a corporation or group with consolidated or combined corporations a partnership a limited liability company and a state a trust a governmental agency or any other organization association or group it's important that the forms be filled out completely and correctly incomplete or incorrect forms will not be processed and will be returned for correction the following tutorial will give you information on how to correctly file in Arizona form 285 additional information can be found in the Arizona general tax procedure 15-2 available in the department website at WWE CDO Arif of section 1 of the form 285 is for the taxpayer information there is space to enter the taxpayers name address and a time telephone number if more space is needed an additional page can be attached if the taxpayer has a foreign address the address should be entered in the following order city province or state and country follow the countries practice for entering the postal code and do not abbreviate the country's name the type of identification numbers needed in this section will depend on the type of tax paying entity and type of tax matters the form will be covering for income tax purposes each individual signing this form must enter his or her social security number a corporation partnership trust or a state must enter its employer identification number or a for withholding tax purposes an individual corporation partnership trust or estate must enter its employer identification number for transaction privilege tax purposes an individual must enter the TPT license number a corporation partnership or trust must enter its TPT number if the corporation partnership or Trust has more than one location also enter the corporation partnership or trusts EAN an estate must enter the estates TBT license number section two is for the appointees' information please note the appointee must be an individual the first and last name and address of the person the taxpayer is appointing to receive confidential information and to act on the behalf of the taxpayer is to be entered here if the appointee has a foreign address the information is to be entered in the following order city state or province and country use the country's practice for entering the postal code and do not abbreviate the country there are spaces for the ID number of the individual appointee the ID number may be an SSN CPA...

Fill arizona 285up : Try Risk Free

People Also Ask about arizona form 285up

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your arizona form 285up online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.